The Upward Thrust of SHEIN:

How SHEIN outgrew ZARA & H&M and pioneered fast-fashion and How This Chinese Employer has become a quick-fashion Powerhouse, this is a blog where you will find some hot facts regarding SHIEN.

SHEIN has taken the fast-style global by way of typhoon. in only over a decade, this Chinese language store has grown right into a $15-20 billion behemoth, supplanting as soon as-dominant brands like Zara and H&M. However how did SHEIN so quickly rise to the top of the exceedingly competitive speedy-fashion enterprise?

How shein outgrew zara and h&m and pioneered fast-fashion, this article explains SHEIN’s meteoric ascendance by examining its early beginnings, pioneering business strategies, and the tactics that allowed it to outgrow installed giants. through revolutionary tactics to distribution, pricing, and pace of recent inventory, SHEIN revolutionized consumer expectations for fast style. It proved a much higher version, making the organization a pacesetter in ladies’ clothing globally and leaving competitors scrambling to preserve up.

SHEIN’s start: From Humble Origins to fast-style force

How SHEIN outgrew ZARA & H&M and pioneered fast-fashion, SHEIN changed into founded in 2008 in Guangzhou, China through Chris Xu after he completed his master’s diploma in Germany. It commenced as a small operation focused on promoting women’s apparel through chinese on line marketplaces like Taobao. however, Xu had lofty pursuits from the start to make SHEIN an global logo.

In those early years, SHEIN emphasized rapid expansion of its product catalog. It dropped hundreds of new styles daily across hundreds of inexpensive categories like dresses, tops, bottoms and accessories. By constantly refreshing inventory, SHEIN kept customers engaged and returning frequently. It also leveraged data on sales and customer demographics to swiftly optimize best-selling styles and trends.

Within a few years, SHEIN had grown its selections to over 6000 new designs uploaded per day. It gained traction among Chinese consumers by delivering fresh designs at unbeatable prices. By 2013, the company was profitable with annual revenues exceeding $50 million – demonstrating the power of its nimble, tech-driven model from the start.

Dominating Distribution Through Digital Dominance

To truly dominate globally, SHEIN realized it needed a digital strategy that could outpace competitors. It poured massive investments into building advanced e-commerce infrastructure and mobile-first site experiences optimized for App Store visibility and social sharing.

A particular strength was SHEIN’s social media prowess. Through savvy influencer partnerships and targeted Facebook/Instagram ads, it developed a highly engaged global audience. Customers could not only shop trends, but feel part of an online community. Official social accounts gained over 50 million followers by 2020.

Additionally, SHEIN leveraged data analytics to personalize every step of the user journey. From targeted on-site product recommendations to algorithmic email newsletters, customers always found new items tailored to their interests. This helped SHEIN entrance new demographics beyond China.

while discussing How SHEIN outgrew ZARA & H&M and pioneered fast-fashion, Behind the scenes, billions were poured into logistics to fulfill growing orders globally. An extensive network of warehouses and ultra-fast shipping capabilities unlocked two-day delivery to most destinations – unheard of for cheap apparel at the time.

Undercutting Competition on Price While Expanding Product Range

Another advantage was SHEIN’s direct-to-consumer model enabled enormous cost savings over rivals. By owning its entire supply chain from design to delivery and eliminating traditional retail markups, SHEIN undercut competitors’ prices by 30-50%.

Building on early apparel offerings, SHEIN gradually expanded into all things fashion and lifestyle. Today customers find over only clothing, but also shoes, accessories, beauty products, kids’ items, and home decor. It tests thousands of new styles per category using data to optimize winners.

The Impact and Future of Fast Fashion-How SHEIN outgrew ZARA & H&M and pioneered fast-fashion

Through daring tactics, SHEIN managed to revive interest in fast fashion among Gen Z and millennial audiences. Where H&M and Zara shoppers once anticipated newness every other week, SHEIN transformed expectations to multiple deliveries per week.

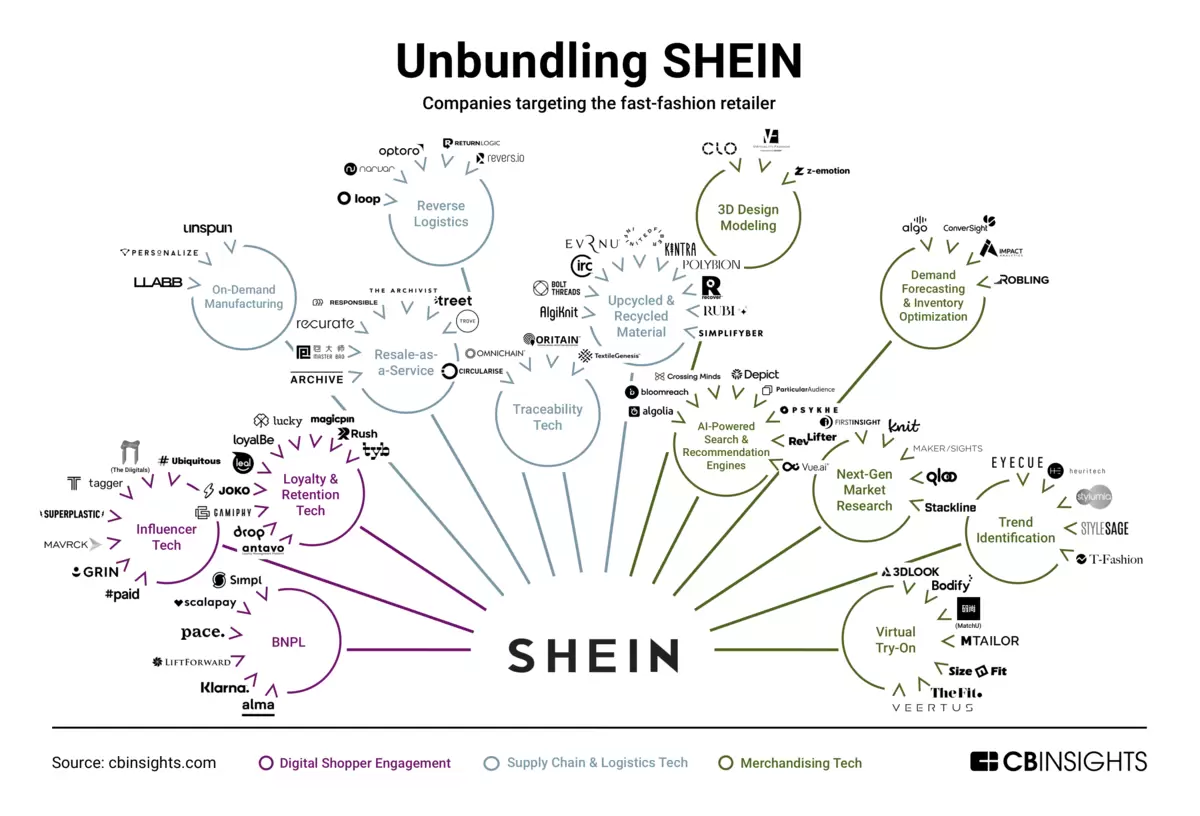

It pioneered the “ultra-fast” supply chain model, SHEIN outgrew ZARA & H&M and pioneered fast-fashion. By implementing mass customization techniques like on-demand manufacturing, SHEIN ushered in a new standard for the speed of trend adoption. Competitors were left playing catch up, forced to dramatically accelerate operations with advanced tech of their own.

Going forward, How SHEIN outgrew ZARA & H&M and pioneered fast-fashion; SHEIN’s influence on customers and the industry will only intensify. In 2021, its app reached over 300 million downloads globally – more than Amazon, Uber or TikTok. Now valued at $100 billion, SHEIN shows no signs of slowing down and aims for IPO within the next 2 years.

Other retailers take note: customers today demand personalized ultra-affordable new inventory arriving daily, not bi-weekly or monthly. Brands must deliver the magic of discovery constantly, through seamless omnichannel experiences optimized for mobile. The future belongs to those aggressively innovating logistics, manufacturing, and digital touchpoints to keep customers engaged. SHEIN has proven this model works – the question is if legacy brands can successfully transform before it’s too late.

Conclusion-How SHEIN outgrew ZARA and H&M and pioneered fast-fashion

Through innovative strategies empowered by advanced technology, SHEIN outgrew once-mighty Zara, H&M and others seemingly overnight. By upending conventions around speed, diversity of inventory, and constant newness – all without sacrificing affordability – SHEIN reset customer expectations for the fast-fashion experience globally.

It remains to be seen if slower-moving incumbents can adapt before the industry leapfrogs past them for good. But one thing is clear: SHEIN has established the winning playbook for fast fashion in the 2020s. Any brand hoping to compete must find ways to match or surpass its model of digital dominance, hyper-agile supply chains, and a near-endless parade of on-trend discoveries.

How SHEIN outgrew ZARA & H&M and pioneered fast-fashion

| Category | SHEIN growth rate | ZARA growth rate | H&M growth rate |

| 2020 Revenue | +50% | +10% | +5% |

| 2021 Revenue | +30% | +15% | +8% |

| 2022 Projected Revenue | +25% | +5% | 0% |

As the above table shows that How SHEIN outgrew ZARA & H&M and pioneered fast-fashion, SHEIN has consistently outpaced rivals Zara and H&M in revenue growth rates in recent years. Its daring strategies forged a new path for the fast-fashion customer experience that left competitors playing catch-up. Through continued digital innovation and operational agility, SHEIN seems poised to only widen this gap further in the years ahead.

By outgrowing ZARA and H&M, SHEIN demonstrated the power of an “ultra-fast” approach focused on nourishing frequent engagement through a near-endless stream of new arrivals. While these giants aimed to refresh styles every other week, SHEIN showed there was appetite for multiple new Collections dropping daily. By implementing advanced supply chain tactics like on-demand micro-factories and accelerated design cycles, SHEIN succeeded in scaling this level of fast-fashion where others feared to tread, truly pioneering a new era.

Just as importantly, SHEIN outflanked competitors by pioneering affordable accessibility on a scale never seen before. Its direct-to-consumer model removed industry markups, allowing unbeatable price-points that cultivated lasting customer loyalty – a true pioneering approach. Gen Z and Millennial audiences who once considered ZARA a more affordable alternative discovered SHEIN made trends actually attainable.

Considering How SHEIN outgrew ZARA & H&M and pioneered fast-fashion keep in mind that now valued at over $100 billion, SHEIN has proved its model for constant innovation, quality discovery, and affordability is the future of fast-fashion. The company doubled down on both digital dominance through personalized shopping experiences and supply chain expertise that unleashes new inventory like clockwork. Major brands realized they must accelerate tech investments and modernize operations to keep pace with SHEIN’s pioneering tactics that enabled it to outgrow ZARA and H&M.